Geek'n'Rolla, RIBA

Arrived at a very reasonable registration time of 10am.

Intro, Mike Butcher: "the wi-fi *is* going to go down".

The event is all about startups - being a startup, what it's like. Lots of folks from across Europe.

Notes on the talks below:

- Europe: the Good, The Bad and the Superbad; not sure I really followed this one.

- The Masterplan: building great teams; absolutely fantastic advise.

- Building a company on a cloud infrastructure; quite technically in-depth, lots of useful detail.

- Monetising startups; well out of my area of expertise or interest so found it hard to get excited about;

- Trials of a mobile apps startup;

- What startups get wrong about usability;

- Panel discussion on Women in tech startups - really lively debate between panel and audience;

- Bootstrapping, scaling and cashflow; absolutely fantastic talk about launching LoveFilm;

- Launching your startup in the US, when you are actually in Scotland;

- Geek Tools, A Primer;

- How to be a startup that wins, excites and keeps users;

- Dealing with Angel Investors;

- Recession business models for tech startups:

- To VC or not to VC: That is the question;

Overall impressions:

- Very good male/female balance amongst the speakers

- Most speakers gave me the sense that they were do-ers, not thinkers. I liked this :)

- A really good strike rate of talks. Huddle.net, William Reeve and Jof Arnold were particularly excellent. 3 of this standard in a day is quite rare IMHO.

- A nice spread of topics; the tech stuff was usefully deep and the business side of things felt honest and drew on both successes and failures;

The Final Countdown - Europe: The Good, the Bad and the SuperBad: Inma Martinez, Stradbroke Advisors

Inma walks onstage to "The Final Countdown" - very brave way to start a talk :)

Youtube and Google are the good guys. ThePirateBay are the bad guys.

Shows some clips from the IT Crowd.

Talks about privacy implications in Europe vs England (where we're used to being on CCTV constantly).

What does this mean for now? It's in times of recession that most companies are born. European entrepreneurs are different: they have no unified front, speak different languages. We ask VCs for money and promise them we'll conquer the world... or stay local and hope to be bought. Why do we have to go to an overcrowded Valley? "Anything you launch in the US cascades into other countries". But it's not easy to be in the US.

European startups are good at adapting to new markets.

"Most people form companies with friends or people they come across that are funky - that's the wrong approach".

Apparently, if we don't sell products and make money, we'll run out of money and go bust. Don't spend ages doing R&D until you go bust.

Europeans are dragged by US trends. Ovi store supports 400m handsets, iPhone 30m. Online advertising isn't much of a business model. Why expect that VCs will fund a startup going onto an overcrowded platform like the App Store?

Why are we only good at design?

The Masterplan: Andy McLoughlin, Product Director, Huddle

The Masterplan: Andy McLoughlin, Product Director, Huddle

We have lots of great product and tech people in the audience. Our problem when we started was taking the founding team and expanding it... building a team you could trust to build the company.

Huddle is a collaboration platform. Funded December 2007, growing from 5 to 30. Had lots of problems over the years, learned a few lessons:

- Building a great time is hard work, and takes a fucking long time; but it's rare that you get to choose the people you work with, so make sure you do it properly;

- The initial team may not make the grade. Huddle sacked 2 of their developers when they took funding - not because they're bad, but because they weren't going to be good enough.

- If you have any doubt on a hire, say no. It's much harder to get rid of them further down the line.

- Don't hire someone you wouldn't want to spend all day, every day, with.

- Working with a startup isn't for everyone.

- Bet on smart, entrepreneurial people, even in areas like marketing and support.

- Build "a team of peers": where everyone is involved in hiring everyone else, so there's a great sense of buy-in.

Huddle technical interview process:

- Telephone screen (20m)

- Paired technical test (1h): written tests aren't worth shit, so sit them down and go through it.

- General interview (30m) with CEO, CTO or Product Director, to ensure cultural fit.

- Huddle patented "4 point scale". Everyone who's involved gets a vote: unless everyone agrees it's definitely yes, they're not in.

Openness everywhere:

- Keep the team in one building;

- Publish company targets and roadmap: if you're running behind on revenue and people know it, they'll pull out the stops;

- Weekly open-floor standup with questions from anyone about anything;

- Engineers and product on sales calls;

- Sales and marketing folks do testing;

- Company-wide product planning sessions;

- 10% hack time;

How do you find talent? Public speaking, twitter, blogging, LinkedIn (cheap and very good). But these sometimes can't be fast enough post-VC funding, so you have to deal with recruitment agents: "generally, they're bastards and full of shit". Create a Preferred Supplier List (max 15% commission, send 3 best CVs of available candidates).

Interns: a grey area. Can be something for nothing, as long as they're not held to a work contract and they're learning.

People won't be with you forever. The first time someone leaves it's heartbreaking, but it's inevitable. Look for early signs of unhappiness. Pay market rates or above. Follow proper procedures if you've instigated the break-up. Go on an HR course.

Finally, how do you create a place people want to work at? Huddle have "dress-up Friday": tuxedos and ball gowns. Put 10% shareholding aside and distribute across staff. Invest in a great coffee machine. Eat together regularly, it makes you feel like a family.

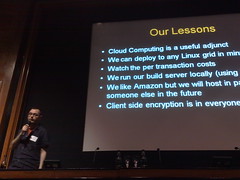

"Hey you, get off of my cloud - Launching your startup on a cloud computing infrastructure", Joe Drumgoole, Putplace.com

"Hey you, get off of my cloud - Launching your startup on a cloud computing infrastructure", Joe Drumgoole, Putplace.com

Founded a company to do online backup. When they started, storage was $5/GB: hopelessly inefficient in terms of cost. We betted that the cost would go down before we had to charge for it. When we started we couldn't afford hardware. We had to think how to save capital for the data-centre spend anticipated at the end of 2006.

Amazon launched S3, taking storage from $5/GB to $0.15/GB.

Host *everything* in the cloud: Wush.net for subversion/trac. Hamachi for VPNs. Paypal for billing. Zendesk for support. Hudson for build server.

Amazon is cheap for storage, but expensive if you're transferring stuff in and out all the time. 25% of our total cost of storage was down to PUTs and GETs. Mogile let them aggregate 250gb of free storage/node, eliminating 25% of costs. Per-transaction costs will kill you if you don't watch out for them.

Monitoring is very important if you're not hosting boxes; they use Nagios to get a map of all systems. Monitis gives uptime counts for all the other services. They manage the whole grid with 1 part-time programmer.

So what's the bad news?

It takes a long time to get stuff into or out of the cloud, or you'll pay lots for good bandwidth. For mission-critical stuff, you need to think about how you can work locally and remotely. Don't depend on a single cloud vendor - everyone fails right now. We always run a multi-tier system: master data in S3, working data on MogileFS/EC2 (and could be hosted elsewhere).

The dynamics of cloud programming are dollar-based: you need unit tests that work out costs per transactions. If you put a simple DB query inside a tight loop instead of outside, and put it out to 20-30 nodes on a grid, it'll start costing you money. Your dev team need to be aware of this and your unit tests need to track cost value. They also need to know that you're living in public: security is important. The Oracle Security course is really good: every developer should know they're a waypoint for a potential hacker.

Someone else owns the storage. If Britney Spears joins and uploads her photos, an operator at a cloud vendor or in your team might take them and sell them to the papers: encrypting customer data becomes really important. Every single account needs ecnryption, decryption, and audit control of data.

Users may do things to expose your system: lose passwords, use things wrongly, and so on. You have to deal with this.

Capex for their business was £24k - laptops, 1 router, 2 switches and a build server.

Original running costs for the grid were EUR1000 per month, for 8 nodes including storage and bandwidth.

Monetisation is all about getting traffic cheaply and then getting a good price for it.

Low cost of acquisition is good.

Trend in advertising: CPM taken a 6% drop in the last year.

5 practical steps:

- Don't rely on advertising. CPMs have been dropping over the last few quarters. You can't expect >50p PCM.

- If you do, go direct - monthly tenancy with number of sponsors; sponsorship opportunities; genuinely empassioned sponsors; create interactive promotions;

- Affiliates are your friends; works with lower traffic volumes, text-links convert the best, seeing 13% growth vs 9% overall online advertising; allows for a lot more creativity; look at Mashery, who work with BestBuy, NetFlix, Etsy to create a developer API to encourage mashups

- Social Media/UGC converts well, to the extend that FTC is putting holds on word of mouth marketing. Affiliate links can have a 10% conversion rate, twitter even higher. Caveat: you need to be much more considerate.

Hmm, feels like the more you have advertising masquerade as contact between people, the more effective it is: fakeness proportional to success?

"What's the frequency Kenneth? - The trials of a mobile apps startup" Jof Arnold, GymFu.com

Just come back from SeedCamp. Show of hands for mobile apps developers, and mobile apps investors. Many of the former, few of the latter (as you'd expect).

Going to talk mainly about Apple, but what's true of them is true of other stores. Apple just have more stats.

1m iPhones in UK (Apple, March 09)

Shows stats for top-selling iPhone apps: e.g. Trism selling >$500k. You probably won't get rich, though.

Lots of challenges:

- Coding/maintenance

- Multiple platforms (yes, even with iPhone)

- Apple are your worst enemy and best friends

- Discovery

- Pirates

- They're harder to monetise

iPhone app is about 5x as complex as a web site, projects take 5x the time. Fart apps take <1 day.

Initial approval for an iPhone app took 2 weeks.

Submission took 2 days

Now it's about 1-2 hours.

The approval process:

- Apple approval staff are overworked;

- Make sure you obey the rules;

- New apps take a week to approve (reckons their internal metric is 5 days); if it takes more than that, you've probably failed;

- Revisions can take 2 weeks;

- Don't bother asking why, don't argue, just resubmit;

There are big differences between OS versions and hardware of iPhones.

Your app is unlikely to be found. 1500 new apps/week, 22.9% of apps are games (v competitive): you're up against 10,000 if you're doing a game.

50% of App Store purchases are by complete chance, 50% by advertising.

Tricks: force updates into the system, but your competitors update many times a week too to keep themselves at the top of lists.

How critical is discovery? VERY. Top 100 apps get 2.3x downloads, top 25 get 10x downloads. Outside that, you'll get 5-10 downloads/day for paid apps. To get in the top 25 you have to get 25,000 downloads/day.

What happens once you have an audience and traction? Monetisation options:

- free with ads

- pay-for-app, though adjusting price makes a big difference

- lots of apps are ad-supported, purely because AdMob are good at marketing: there's no other reason, the revenues don't justify it

- ad-supported can pay though: Tapulous have done a really good one, lots of co-branding with NiN. Key is improving engagement and returns.

There are opportunities in the app store. If you can kick out a game in a few days and make a small fortune: great. In reality, serious apps take weeks: does $600k justify a 6-month dev schedule? Marketing is king.

Consider the app store as a long-term play: Pandora did this well, so did Facebook. Lots of opps for existing startups, but be careful to separate the myth from reality.

Q: For any entrepreneur looking to go to iPhone, should we take it in-house?

A: There's an opportunity cost for doing this in-house, and no-one's an expert yet. There aren't that many good developers there yet - unless you're good with memory management, careful with coding, it's hard to push out a flawless app. If you're doing your own startup you might be motivated to push it out quickly.

Q: Do we have to create an app, or should we use HTML to develop a web app for iPhone? Can these be marketed on the app store?

A: A few customers came to us wanting an iPhone app. Some customers came to us wanting one, when they had a good web app. Safari does persistent storage with HTML5, 3D transitions, etc. You can judge hardcode a web view into an iPhone app if you like though. Don't assume the app store will market itself though.

Works with companies to define and understand their audiences, so they can do the best job of building services people want.

This can be expensive. Here are some starting points though:

- Pick an audience, there's no such one as "the generic public". You can't design for everyone.

- Get to know them well; don't assume, beware stereotypes. Find them, watch them, talk to them. Lots of design is done on stereotypes, not research.

- Design for your audience; consider using personas.

- Think big and small, from proposition down to appearance.

Try it. Practice. There's lots of help out there - designers to do it, or to train your staff. There are some great books.

Q: We're really focusing on usability, but we're finding our beta testers are abroad, so we're remote from them. How can we conduct usability in this way?

A: Ideally, you sit next to them. So, go somewhere central and set something up there. Try doing a remote session using Adobe Connect.

Q (Tim from Google): a lot of our UX stuff is defined by data. What advice do you have for startups to use data to drive UX design?

A: Data is invaluable, to learn how people interact with your site. Relying purely on data means you don't know *why* it's happening. It's worth doing some observational research to find this out.

"Just a Girl - Balancing Tech Culture: Getting more women involved in tech startups"

Panel is:

Sophie Cox, Worldeka.com

Zuzanna Pasierbinska-Wilson, Huddle.net

Cate Sevilla, BitchBuzz, moderator

Nacera Benfedda, Director of Product, Viadeo

Leisa Reichelt, User experience consultant

Paul Walsh couldn't make it, so a banana in a bin has been substituted :)

CS: Wants to find out how we balance our tech culture male/female. Lots of people try to pretend a problem doesn't exist.

CS: Why do women leave, or not choose to work in, the tech industry? HBR suggests women get fed up working in "a macho culture"; that they experience feelings of isolation; they're uncomfortable working in a culture that encourages risk-taking; or in positions that require time-specific commitments incompatible with family life.

CS: 1996-2004 the number of women in IT declined 10%. How can we change the game, or does it need changing?

CS: Are there simply less women who want to be in tech?

SC: It's more systemic than that. Look at education, how information about these sorts of conferences is disseminated.

CS: Is it because women don't want to be here, or because there's something stopping them being here?

ZP: I've done a lot of research into this. 50% of respondents said that women don't get into them because they don't want to. Few blamed education. Less than 1/3 said it was a lack of role models. But I think there's more to it than this; women constantly make choices and sacrifices, around career, family, or a combination of the two. Is family life compatible with less job security, long hours, etc? Even if you're up for it, you're competing with men. Then there's an "old boys" hiring network, hiring in their own image. One respondent to my survey said "it's like not being let into golf clubs".

SC: But the tech scene is quite liberal, left-wing, equal opportunities - particularly compared to the city-boy network, technology is a good place for women. We also have more flexible working hours, potentially. It's ridiculous that it's happening in this culture.

CS: Women don't like cultures that value risk. Is there anything to that?

SC: It's personality-driven. I like risk, I hate working for other people. Women in some positions might be more risk-averse.

LR: Women who aren't developers (designers, management, etc.) define themselves more by their skills - e.g. I have friends working in tech PR who identify with the PR aspect of their job, not the technology side of it. Maybe it's about how they define themselves?

SC: This also relates to education. Girls don't want to be involved in tech because they perceive it as an uncreative area. This is bad PR for tech in general: it's one of the most exciting industries out there.

NB: In France we recently did a study on how women feel in computing. 75% of female computer scientists say "I'm working in computing", 95% of the men say "I'm a computer scientist".

A Man Takes The Stage (someone from The Telegraph)

Man: I'm uncomfortable with this discussion, I've found it patronising to women. Having come from an environment in law, publishing, finance, I think women in tech have a good deal. There are reasons (nothing to do with prejudice) why they're not involved, and that should be fine. If it happens that tech is a sector where men succeed for certain reasons, why should we apologise for this?

CS: How can we approach this?

Man: We need a large piece of systematic research, to look into this.

NB: I have much of this research.

SC: Would that research not just be "what the differences are between men and women".

ZP: Should we have done research into why women should have the vote?

Q: We've had nearly 3/5 women here mention they've looked at reports bringing it up, then a man comes up saying "we need research". Setting up technology companies is like setting up any business: most startups everywhere are set up by men not women.

LR: You're implying that the people doing the work right now are doing it because they're best for the job. I have a 15m old son, I can't commit to a tech-startup lifestyle. This doesn't mean I'm not one of the better ones for the job.

From the floor: Some of your facts aren't correct. Women are starting up companies at twice the rate of men in the US and UK. They're less visible in high-growth startups; there are two hurdles: they aren't getting VC money because they're less connected with investors. And their own leadership problems: they often don't want high growth. When they run high-growth companies, there's no difference between the sexes.

From the floor: Lots of men *go into* the industry in order to feel isolated, that's why quite a few of them are here. It's not unique to women! As long as 50% of the tech market for products is female, women will have a crucial role.

From the floor: we did some research last year. There's more women on social networks, but fewer women doing the work. We think any company using women to design or do user research has an advantage.

From the floor: no-one has talked about the fact that most tech startups are started by developers, mainly men.

CS: So we should have more female developers?

SC: I don't think anyone wants fewer men to set up businesses. Education, getting more women involve with developing, having women step back from defining themselves non-technically,

From the floor: I started a company in 99 and raised money. I have two children. I like being in this industry because it's so liberal (I used to work in finance!). For me, a lot of it is about the perception of women as to whether the industry is interesting for them. I started out as a developer but was quickly moved into areas where I was more involved in managing and communicating. I think as women we often stop ourselves; I don't think the men are stopping us.

From the floor: I have 3 children: 1 girl, 2 boys. It's already obvious that the environment around our daughter isn't supportive of that. Already in primary school girls are being put in an environment where they're not being asked to succeed in this way.

NP: What kind of toys did you offer your daughter at age 3-4?

Floor: We were conscious of trying to not give her dolls and the boys cars.

Floor: we need to show 13 year old girls what technology can be doing for them to change the stigma

Floor: There's cruder places: try finding a boyfriend at work if you work at Vogue! Many sectors suffer these unbalances.

"Get on your boots - Bootstrapping, Scaling and Cashflow" William Reeve, Serial entrepreneur and Angel investor

"Get on your boots - Bootstrapping, Scaling and Cashflow" William Reeve, Serial entrepreneur and Angel investor

Founded LoveFilm, merged from DVDOnTap, ScreenSelect and VideoIsland: all of which had strengths and weaknesses.

1 year after DVDOnTap launch, ScreenSelect and VideoIsland launched - both credible competitors, competing head-to-head. DVDonTap has 1m angel funding, VI was VC-backed and best-capitalised. SS was angel-backed to the tune of £2m in the first 12 months.

Funding didn't translate to user numbers for VideoIsland.

The boot-strapped business beat those with cash for the first 12 months.

In 2006, cashflow beat money.

At acquisition time, SS had 17,810 subscribers, VI 11,315. VI had lower burn: hire behind-the-curve (less experienced people who could do the job, not expensive experienced people who had done it); build in-house (not license and refactor); £3k pcm on professional services vs £20k pcm. This meant SS burned slower.

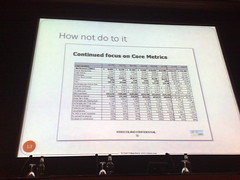

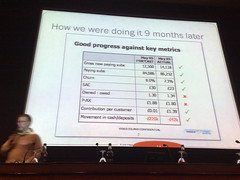

Post-acquisition they simplified metrics and reporting massively:

Expert advice:

- Renegotiate all contracts (incl landlord) - suppliers will try not to lose you;

- Review inhousing vs outsourcing;

- If there's any doubt when spending, say no;

- Get customers onboard early, have them fund development in return for discount

- Investigate R&D tax credits

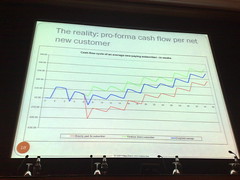

Shows interesting slide of cashflow of customers. Customers pay after 2 weeks, but you don't start paying suppliers for acquisition costs and DVDs for a little while... so cashflow is better than it might otherwise seem. It's even better for revenue share subscribers - the customers are effectively funding the business.

Shows interesting slide of cashflow of customers. Customers pay after 2 weeks, but you don't start paying suppliers for acquisition costs and DVDs for a little while... so cashflow is better than it might otherwise seem. It's even better for revenue share subscribers - the customers are effectively funding the business.

Lesson: decouple growth from requiring funding.

Cash conversion tips: establish personal relationships with people in accounts departments.

Have finance be fairly nasty: they got an extra day of payment time from each supplier, each month, through a variety of fairly questionable techniques. Helped to have finance be separate from sales.

Suppliers, especially payment partners, can help. With marketing partners (massive expense for LoveFilm) they insisted on performance-linking, which was a form of credit.

How to scale: culture. The CEO owns it. It's like blonde hair; we all like it, some have it, but not genuinely. Keep the business simple. Scaling beats revenue and profit. Amazon take this *very* seriously. Scaling is the only thing more important than revenue and profit, even in a credit crunch.

They got a lot of useful data about Netflix by dint of their going public and having to publish data.

Q: There's a lack of subscription billing models for startups to use in the UK. How much effort did you put into this?

A: SS put a lot of effort into payments. If you're billing £10pcm, billing fees are an impact on your gross margins. LoveFilm used DataCash which was excellent and resilient. We built this resilience ourselves in-house using 2 billing suppliers, saving ourselves £300k eventually.

News prediction site using virtual currency. Launched 1y ago, high-profile, mentioned in 100 media sites (TechCrunch, Wired, etc.) Based in Edinburgh.

70% of market is American. They're UGC-driven, launching early. Launched in the US because it's the biggest market. They have lots of US competitors, but focused on US only (not UK)

Use conferences to launch your new product (they used Demo08). They hired a PR agency, spending 1/3 of their seed money on the launch, and it worked.

Post-launch they travel to the US once per month, but cheaply. Schedule back-to-back meetings, sleep on the plane.

Got US-based advisors. Network constantly, or go direct to others with requests for help.

Identify super-users. They did so, and hired from them (I remember Mindcandy doing this too).

The small stuff: do sweat it. Get a US phone number, use Skype. Cultures are different - steep yourself in them.

Spelling, slang, etc., can make a difference. Humour can be easily misinterpreted. Respect customers and learn from them.

They had no office or any legal entity in the US.

"We don't need no education - Geek Tools, A Primer" Ian Hogarth, Songkick.com

Started SongKick with Y Combinator in Boston.

A walkthrough of other sites that might be helpful.

"Have Love, Will Travel - How to be a startup that wins, excites and keeps users"

Moderator: Mike Butcher, TechCrunch Europe

Panellists:

Wendy White, Moonfruit

Keiran O'Neil, Playfire.com

Nic Brisbourne, DFJ Esprit

Ryan Carson, Future of Web Apps / Carsonified

NB: Google, Skype, Last.FM: all jaw-dropping services. You need a huge market and fantastic team too.

RC: You need a good product. Presuming you have that, you need a story as a company: integrity is ours. As soon as you say this, people question it; but at least it's interesting. I'd rather be a company with personality and belief than not. Have a good product, but be interesting.

MB: Like Google's "don't be evil".

NB: Having the courage to say you are something implies that you're saying you're not something. And as a small company, you can't be all things to all people.

MB: What's been your journey, Wendy?

WW: I founded in 99, we raised money in the first dot-com boom, then hit the crash. Went from 50 to 2, but despite scaling down we had 1/2 million users who were loyal: a percentage of them were happy to pay us for it. One of our customers was 12 when he started with us, now he's 22. Partly through twitter, we've had a lot of feedback through customers. We moved to agile 2 years ago, so we can be responsive to our customer-base; it wasn't a technical fad. We release every 6 weeks to our customers. Our marketing has become more agile around that.

RC: As Kathy Sierra pointed out, no-one gives a shit about your company. They want their own needs met. Your whole marketing effort should be able empowering people to do what they want to do. No-one cares about companies.

NB: Tara Hunt has a load of presentations about making happiness your business model.

KON: PlayFire is there to solve one problem, but once you're in there for the community you start to care about the site.

...

"Send me an Angel - Funding and how to handle Angels"

Nic Halstead, Favorit

Why angels? Quick turnaround. Less due diligence.

Started out at OpenCoffeeClub. Angels tend to walk around listening, trying to spot individual stuff. They don't advertise themselves. They don't invest often, they network well and they know each other (particularly within regions).

One option to get angel attention is "pay to present": typically up-front £350-£500, with no guarantee of investment of course. Very few focus on a single sector, so chances of being in front of someone correct is low. The effectiveness of these events is questionable.

There are sharks, too... wanting a large up-front fee and a percentage. So 5% to shark, 5% to angel network of a £250k investment = £25k in fees!

When dealing with multiple angels, you need a lead investor to help herd them up. Otherwise your solicitor is arguing with lots of individuals.

Build a plan of how to find them, get a good lawyer.

Q: You mentioned that business angels are often strong characters. How do you stop them influencing product design etc?

A: I've been lucky; our angels are in software but have little Web 2.0 experience, so they bring skill in growing companies, not product work as such.

Floor: We raised angel money last year. Lots of institutional VC funds have an angel or partners fund on the side. We ended up taking angels and VC in the US, that's another opportunity.

Q: If you have 10 angels, how many do you offer non-execs and board seats.

A: Don't have a board bigger than the company! One angel is nominated from the ten, and we had an observer too. More than that gets silly.

Q: How do you structure share ownership with that many? Voting rights?

A: Individually, they wouldn't have much. Their only right is as a representative on the board, unless it's company-sale stuff.

"Boulevard of Broken Dreams - Recession business models for tech startups", Reshma Sohoni, Seedcamp

Think through a biz model early, don't just build and worry about survival.

There's lots of ways to sell services. Find your best fit.

Devil is in the details and execution: talk to others.

Advertising is getting harder to use as a rev stream.

Freemium is tricky - ensure you have enough in the free services to bring in users, and enough in the vision for the business and product to allow for migration of customers to premium. 2-3% is typical conversion rate, 10% is possible but rare. Skype, Flickr, 37signals, FT did a good job here.

Build a great marketplace (%age of success fee, listing fee, subscription) and they will pay. Or make something and sell it to your customers.

Virtual goods is relevant to specific markets (gaming, VR, etc.) but is it a good fit with your company?

Blend or graduate business models.

Consulting is *not* a business model. It's not your core activity.

"Bankrobber - To VC or not to VC: That is the question"

Fred Destin, Atlas Ventures

Everyone wants a piece of our time. Everyone wants to be our friends. It's why we don't respond well to email. We're trying to build relationships, and we want to have fun. Don't drop your business card or pitch at VCs at events, just have a chat.

Once I see you're credible and enjoyable to be with, that's first step.

To get a meeting... we see 500 projects a year and do 3 investments in Europe. Statistically your chances are poor; but even if I don't fund you, I'll give intros and put good people your way. Shyness is misplaced - I want your business.

My priorities are family, partners, portfolio, my personal brand, managing my deal-flow.

In reality, the deal-flow tends to come back to number 1... because we want to find great opportunities.

We're actively looking at 30 projects. We reassess every week and reprioritise.

The objective of the first meeting is to get a second meeting: tell me the core elements to get me excited, demonstrate you're a credible team, and get me hooked. I will have an urge to invest, then try and rationalise myself down.

After 2 days I remember 75% of your pitch, after 5 days 10%.

People are generally unprepared for questions like: how much money are you raising? Startups should know.

Partnership presentation: don't bring too many people, just one or two. I'm the customer now, listen to me and how I'd like this done.

Building a business is long, painful, and consumes your life. The key is to think that your VC is nothing more than a financing opportunity: maybe it's an appropriate one, but it's just financing. They won't build your business for you. We will help identify strategy, great people, see risks; but the better your management team the less value we'll add. Think 3 steps ahead: when is it time to step down as a founder, gracefully?

Enterpreneurs and VCs have to both suspend disbelief, to do what they do. We also have emotional maturity to say "now it's time for me to evolve, what's the right thing for me to do". You need to manage your way into the growth of the business, usually stepping down.

Israel, India, West Coast US are priorities for investment. Europeans are less hungry, less aggressive, slower.

As an investor I'm extremely uncomfortable with single-person companies.